FMHS Independent Study Program

Independent Study - Senior, Elijah Gonsalves - Accounting

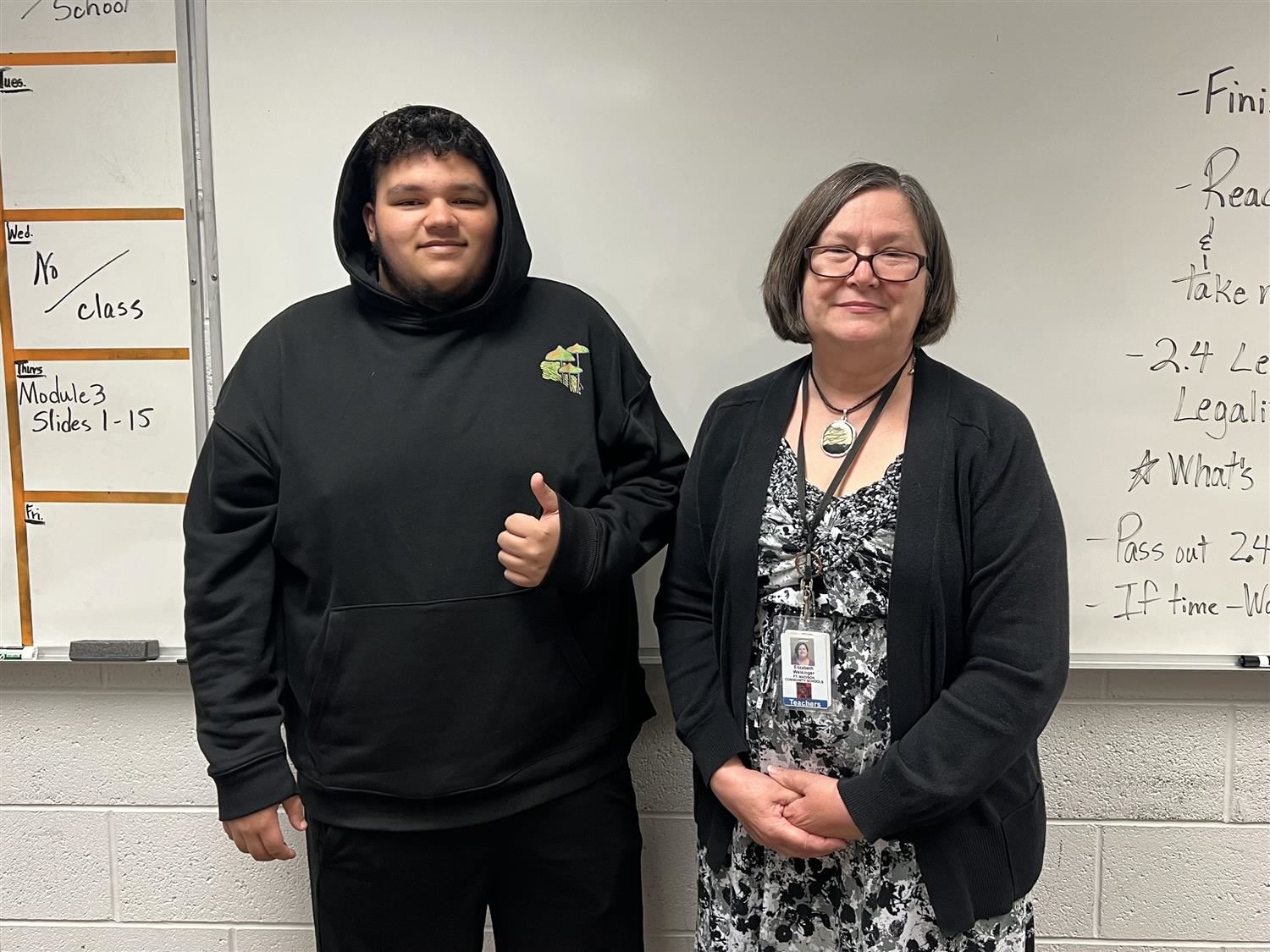

Senior Elijah Gonsalves has been working with Fort Madison High School’s CTE Business Teacher, Ms. Liz Weisinger, as an independent study. Elijah plans to go to Southeastern Community College this Fall to study accounting.

Independent studies are great to have on your college application and to prepare students for future jobs. They are a way for students to take a “class” that your school may not offer. Students are able to work at their own pace, and they get to learn about a more specific topic that they are interested in.

Independent studies are taken to the building principals and the guidance office. Teachers develop a lesson plan that includes a learning timeline and what the student will be able to achieve in such time.

“This is a huge step in the right direction for Elijah,” says Ms. Weisinger. “He is going to already have the knowledge and the awareness of what they are teaching. He almost gets a head start to those classes, which is a huge advantage.”

“I took an accounting class with Ms. Weisinger and I really enjoyed learning about it. I felt like it came naturally to me. I knew I wanted to learn more about accounting and I wanted to work at my own pace,” Elijah said. “We go over one to two lessons a day. I just finished learning about the vertical and horizontal analysis. We will then move into the reinforcement activity, which is a summary of the whole chapter. In the next chapter, we will learn about requiring capital for growth and development.”

Ms. Weisinger also adds, “He is responsible for what he learns. He gets to work at his own pace, and he is moving fast. I may even have to add an extra lesson plan before the end of the trimester! This independent study says a lot about his character. Elijah sets a goal for himself and he goes after it, he has the drive to make things happen. To take that responsibility all on your own is a lot.”

Elijah has already set up meetings through Southeastern Community College where he was able to job-shadow the accounting classes. So far he has job-shadowed payroll and tax accounting.